It’s Raining Lawsuits: Do You Need An Umbrella Policy?

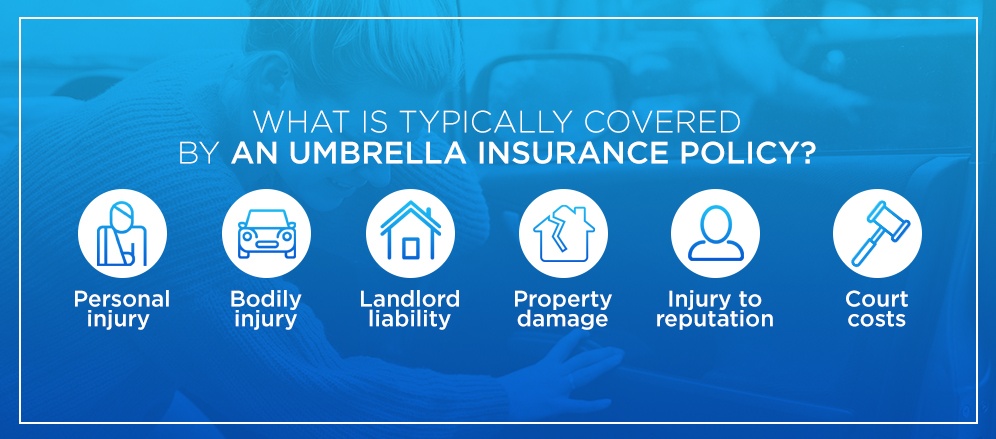

An umbrella policy provides excess coverage above and beyond what is provided by your homeowners and auto insurance policies. As an example, let’s say your auto insurance pays $300,000 of medical expenses per accident and your umbrella policy is for $1 million. If you are sued for $900,000, your auto insurance would pay $300,000 of the damages and your umbrella policy would pay the remaining $600,000.

Umbrella policies usually provide roughly $1 million to $5 million of additional coverage, and it is possible to get more if you have lots of assets to protect. A $1 million policy is sufficient for most people and only costs roughly $200 a year (about $16/month)

Comment (0)